Buy gold bar Singapore, a global financial hub, has long been a popular destination for gold investors. Known for its political stability, robust economy, and transparent market, Singapore offers a conducive environment for buying gold bars. This comprehensive guide will dive into the intricacies of helping you buy gold bar in Singapore with ease , covering everything from the basics to advanced strategies.Remember we are here to assist you through out the purchasing process.

Why Invest in Gold Bars in Singapore?

- Safe Haven Asset: Gold has historically served as a safe haven asset, protecting investors’ wealth during economic uncertainties.

- Diversification: buy gold bar in Singapore from African miners can get you a lot of profit an also help diversify your investment , reducing overall risk.

- Tangible Asset: Unlike stocks or bonds, gold is a tangible asset that can be physically possessed.

- Tax Benefits: Singapore’s tax laws may offer certain tax benefits for gold investments.

Where to Buy Gold Bars in Singapore

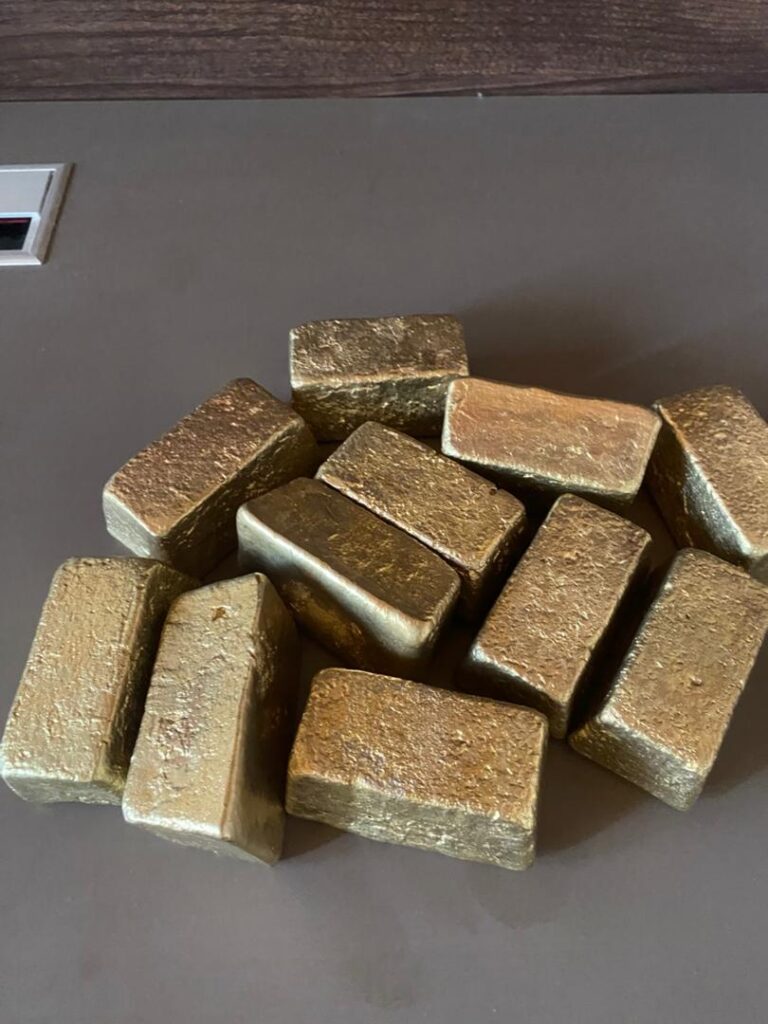

- Gold Shops and Jewellers: Gaga miners gold shops and jewellers often offer a wide range of gold products, including bars , nuggets.

- Banks: Major banks in Singapore may sell gold bars as part of their investment services.

- Online Platforms: Online platforms like us specialising in precious metals can provide convenient and secure options for buying gold.

Factors to Consider When Buying Gold Bars

- Purity: Gold bars are typically measured in karats, with 24 karats being the purest. Ensure you are purchasing gold bars of the desired purity.

- Weight: Gold bars come in various weights, from small ounces to larger bars. Choose a weight that suits your investment goals.

- Brand Reputation: Opt for gold bars from reputable brands or mints to ensure quality and authenticity.

- Storage Options: Decide whether you want to store the gold yourself or use a secure storage facility.

Investing in Gold Bars: Strategies and Tips

- Dollar-Cost Averaging: This strategy involves investing a fixed amount in gold at regular intervals, regardless of price fluctuations.

- Physical Delivery or ETFs: Choose between physically owning gold bars or investing in gold exchange-traded funds (ETFs).

- Long-Term Perspective: Gold investing is often a long-term strategy. Avoid short-term speculation and focus on the underlying value of gold.

- Stay Informed: Keep up-to-date with global economic trends, geopolitical events, and the gold market to make informed investment decisions.

Tax Implications of Gold Investments in Singapore

- Capital Gains Tax: Singapore’s capital gains tax regime may apply to profits from the sale of gold bars. Consult with a tax professional for specific advice.

- Goods and Services Tax (GST): GST may be applicable to the purchase of gold bars in Singapore.

Investing in gold bars can be a valuable addition to your investment portfolio. By understanding the factors involved, choosing reputable sources, and adopting suitable strategies, you can navigate the Singapore gold market effectively. Remember to consult with a financial advisor to tailor your investment approach to your specific goals and risk tolerance.

Buying Gold Bars in Singapore

Leave A Comment